The Crude Oil News

Economic indicators are employed by investors and traders to enable them to comprehend the underlying fundamentals of the market. The particular economic indicator that traders analyze depends on the type of market they are trading on. For oil investors, their major concentration should be on the economic indicators that provide data concerning the petroleum company. Most of the indicators used by energy traders focus on the records and supply levels for crude oil.

Oil Inventories

The most prominent indicators used by oil investors are the crude inventories (Stock levels); it is referred to as the quantity of oil presently stored for prospective use. The amount of the oil needed and any alteration that it undergoes provides traders with an idea of the movement in the generation and consumption of oil over a period. This inventory consists of every U.S crude oil and lease condensate (the combination of heavy hydrocarbons and pentanes) presently stored at the refineries, within pipelines, and at pipeline terminals.

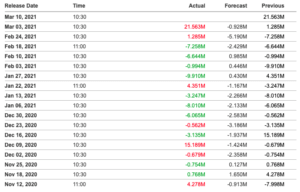

The information is published every week and released by the Energy Information Administration every Wednesday at 10:30 am EST. Energy traders compare the crude oil inventories with the prior levels to have an idea of the future trends of the oil price.

The publication of crude inventories comes with a long list of records concentrated on the production of crude oil; it covers the refinery input, utilization, domestic production, and other inventory categories, including the import and export records. All these pieces of information are referred to when trying to comprehend the fundamentals of crude market oil. For instance, traders will analyze the use of refinery to ascertain the amount of capacity available to obtain additional supply to the market. The refinery input is high, adding more oil through refineries would be risky, and could result in a lower supply and increased prices.

The publication of crude inventories comes with a long list of records concentrated on the production of crude oil; it covers the refinery input, utilization, domestic production, and other inventory categories, including the import and export records. All these pieces of information are referred to when trying to comprehend the fundamentals of crude market oil. For instance, traders will analyze the use of refinery to ascertain the amount of capacity available to obtain additional supply to the market. The refinery input is high, adding more oil through refineries would be risky, and could result in a lower supply and increased prices.

Other Economic Indicators

Oil-specific economic indicators are not the only sector that should be carefully analyzed by order; they should also concentrate on the general economic indicators, like the gross domestic product (GDP), to know the entire picture of the economy. Because if the economy is growing rapidly, it will probably expand more oil than it would if the economy was in recession, this is because energy is an important addition for economic growth.

Why trade crude oil?

Crude oil is the primary source for derivation of energy in an economy, which makes it a very important commodity to trade. A naturally existing fossil fuel can be distilled into different products, such as gasoline (petrol), lubricants, diesel, and other petrochemicals. It is in high demand, traded in large quantities, and highly liquid. Oil trading consists of tight spreads, high volatility, and explicit chart patterns.

How to trade crude oil: top guidelines and strategies

Professional traders follow a particular trading method. They tend to comprehend the fundamental aspects that will influence oil price and then use a trading plan that fits their trading style. Every trading strategy varies, and proper risk management is important, such as the practical use of leverage and preventing top trading mistakes.

An extensive crude oil trading strategy includes:

- Fundamental Analysis

- Technical Analysis

- Risk Management

When a trader comprehends the fundamental supply and demand aspects that influence the price of oil, they can look for potential entries into the market by employing the technical analysis. Once a buy or sell signal is indicated using the technical analysis, the trader can place a trade while implementing proper risk management techniques.

For Example

The next step is analyzing the charts using technical analysis. There are several types of technical indicators and price charts that can be used to watch out for entry signals. No need to use too many technical indicators so as not to make your chart complicated and clustered, preferably use the principal ones to perform your trading strategy.

The chart above shows the use of the Relative Strength Index (RSI) as the main indicator for a buy signal. When the RSI pullback from the oversold region (the green circle), it indicates a buy signal. As long as the technical analysis corresponds with your fundamental analysis, a trader can go ahead to set relatable stop-losses and take profits levels

Risk management

You can properly manage your risks by setting limit orders in each of your trades. Set your take-profit above the recent high and stop-loss at the last low.